Blog > Flood Alert 2025: How Mid-July’s Gulf Coast Rains Are Reshaping Florida Real Estate

Flood Alert 2025: How Mid-July’s Gulf Coast Rains Are Reshaping Florida Real Estate

by

Flood Alert 2025: How Mid-July’s Gulf Coast Rains Are Reshaping Florida Real Estate

Florida’s hurricane season is always unpredictable — but July 2025’s Gulf Coast flood event has already raised alarms. From record rainfall to property damage and market shifts, here’s what every buyer, seller, agent, and investor needs to know about how these storms are changing real estate across the Sunshine State.

- What Happened: July Flooding Hits Hard

From July 13–15, 2025, a stalled low-pressure system and tropical moisture unleashed torrential downpours across Florida’s Gulf Coast. Key impacts included:

- Plant City recorded over 10 inches in 24 hours — classified as a 1-in-1,000-year event

- Mims received 8.4 inches of rain, flooding streets and damaging homes

- Major airports experienced widespread delays and disruptions

- A tropical system later identified as Invest 93L prompted flood watches across the state

Source: Wikipedia – July 2025 Gulf Coast Floods

- The Insurance & Lending Fallout

Even before this storm, Florida’s flood insurance market was evolving rapidly in 2025. But this weather event has heightened awareness of key risks:

- Flood insurance rates rose by an average of 15–18% in 2025 under FEMA's Risk Rating 2.0 system

- Only ~12% of Floridians currently carry flood insurance — putting many at financial risk

- Homes previously outside designated flood zones are being reassessed and, in some cases, reclassified

- Lenders are increasingly requiring elevation certificates, updated FEMA flood map verifications, and full disclosure of prior damage

- Buyer & Seller Strategy for 2025

If You’re a Buyer:

- Request updated FEMA zone classification for any property

- Ask for the property’s elevation certificate, if available

- Look for signs of recent flooding or mold in inspections

- Even if not required, strongly consider getting a flood insurance quote

If You’re a Seller:

- Be transparent about past water intrusion, insurance claims, or drainage issues

- Ensure exterior grading, sump pumps, and gutters are in working condition

- Include flood zone data and drainage improvements in your marketing package

Buyers are more cautious than ever in 2025. Proactively addressing flood readiness can reduce listing time and prevent fallout during due diligence.

- Agent Must-Knows in Mid-2025

As an agent, flood awareness is now a professional obligation:

- Pull updated FEMA flood maps for all listings in coastal, low-lying, or previously flooded areas

- Recommend elevation certificates and mitigation improvements as value-adds

- Connect clients with qualified insurance advisors who understand the local flood market

- Know how to spot drainage problems, roof pooling, or signs of foundation stress in your showings

In 2025, flood literacy is just as critical as pricing strategy or market comps.

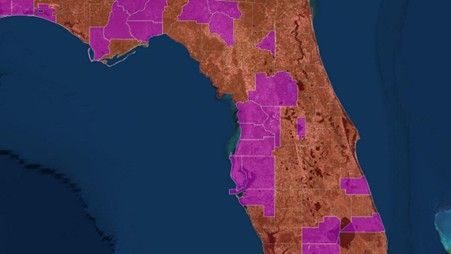

- Why Visuals Matter: Florida Flood Zone Map Context

The map above highlights Florida counties currently under flood watch or impacted by recent storms — but it also reflects broader updates in 2025 FEMA flood zone classifications. Here’s what it shows:

- High-Risk Areas (Zones A and V): Where flood insurance is typically required and storm damage is most likely.

- Newly Reclassified Zones: FEMA and local agencies have updated many inland and coastal areas in 2025, increasing the number of at-risk properties.

Climate Risk & Property Values in 2025

- Flood-prone areas face declining demand and slower appreciation, especially near tidal zones

- Plant City, one of the hardest-hit areas, saw median home prices drop around 8% YOY in June 2025 — reinforcing how extreme events can shift buyer behavior

💬 Final Thoughts

Floods aren’t just a seasonal threat — they’re becoming a defining feature of Florida real estate. In 2025, knowing how to navigate flood zones, insurance regulations, and drainage concerns is essential for buyers, sellers, and agents alike.

At RedRoc Realty, we help clients go beyond the surface. From pulling elevation reports to helping you prepare your home for market, we guide you through every risk with confidence.

📞 Contact us at 786‑898‑0476 or visit redrocrealty.com for flood-smart real estate guidance in 2025 and beyond.

Disclaimer

This blog is for informational purposes only. All projections and examples are based on current 2025 Miami market data. Actual returns may vary. Always consult your financial and real estate advisor before making an investment decision.

🔍 Glossary

- Base Flood Elevation (BFE): The elevation floodwaters are expected to reach during a base flood

- Elevation Certificate: A document that verifies a building’s elevation relative to flood zones

- SFHA (Special Flood Hazard Area): FEMA zones designated as high-risk for flooding

- NFIP (National Flood Insurance Program): Government-run flood insurance program managed by FEMA

- Invest 93L: The tropical system that prompted mid-July 2025 flood watches across Florida

Sources

- https://en.wikipedia.org/wiki/July_2025_Gulf_Coast_floods

- https://www.rateleaf.com/blog/new-fema-flood-zone-maps-in-florida-how-could-they-affect-your-mortgage-and-insurance

- https://www.figfl.com/blog/think-you-dont-need-flood-insurance-in-florida-think-again

- https://www.floridarealtors.org/news-media/news-articles/2025/06/insurance-outlook-brighter-2025

- https://time.com/7303514/how-to-know-your-home-flood-risk

- https://www.nhc.noaa.gov

- https://www.nar.realtor/flood-insurance/flood-insurance-disclosures-what-you-need-to-know-now

- https://en.wikipedia.org/wiki/Climate_change_and_insurance_in_the_United_States

- https://rocket.com/homes/market-reports/fl/plant-city